International Annual Travel Medical Insurance for Frequent Indian Flyers

The Annual Multi Trip policy is ideally suited for frequent travellers who travel multiple times every year. The insured can purchase a single policy for 365 days during which period he/she can travel as many times as they need to, without having to worry about the coverage for each trip. Most insurers offer an annual coverage with each individual trip having a duration upto 30 or 45 days, that the insured can choose from depending on their travel requirements.

The Annual Multi Trip policy is also an economical option when compared to purchasing individual single trip policies each time they travel. In addition to this, it offers the traveller complete peace of mind for the entire year, not requiring them to remember to purchase a single trip policy each time they need to travel. In terms of coverages also, the Annual Multi Trip plans offer the insured a comprehensive range of benefits to take care of any exigency (both medical and non medical) when they are traveling.

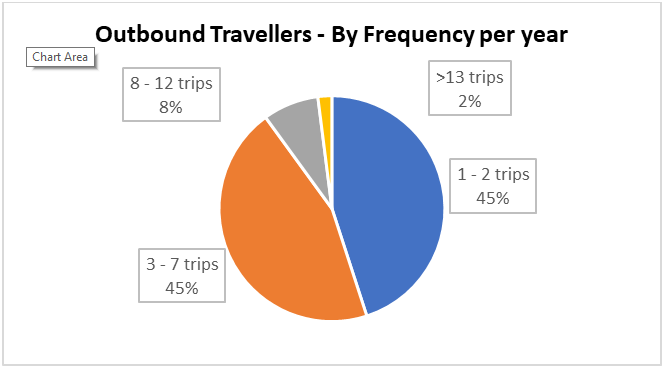

According to an Amadeus report in Asia Travellers with specific focus on the India Traveller, in terms of frequency of travel abroad, almost 55% of all travellers make atleast 3 trips abroad and 10% within this travel more than 8 times each year. This 55% are ideal candidates for an Annual Multitrip Policy.

What is annual multi trip insurance?

Depending on the number of foreign trips that a traveller makes every year, they can opt for a single trip insurance plan or a multitrip insurance policy. An Annual multi trip insurance plan is an Annual policy issued to a frequent traveller and this policy covers the traveller for any number of trips that they make during this period of one year. The advantages of a frequent travelling opting for an Annual Insurance policy is:

- It is more economical that purchasing a single trip policy each time they travel.

- It offers peace of mind to the traveller who need not worry about purchasing an insurance plan for each trip.

- An Annual Multi Trip plan is normally a worldwide policy and hence the traveller is covered irrespective of the destination of travel.

How does annual travel insurance work?

An Annual Multi Trip (AMT) travel insurance plan is suited best for travellers who frequently travel for their business/leisure purposes. An AMT plan is typically issued for 1 year (365 days) and has options of capping each trip to 30/45/60 days.

This means that if the traveller opts for an annual policy with a 45 day trip capping, they will remain covered for each trip during the year upto a maximum period of 45 days. Once the applicable premium is paid by the traveller, an annual policy is issued and this covers the insured traveller for the entire period of 365 days irrespective of the number of single trips that he/she makes during this one year period.

The advantage of an AMT is i) it is more economical to the traveller than buying a single trip insurance policy every time they travel…ii) they do not have to remember each time their travel to buy an insurance cover and hence don’t risk being uninsured when abroad.