Parents who are visiting their children for holidays, going for a tour abroad can buy travel health insurance from Indian insurance providers. There are many companies offering best visitors insurance for parents from India at competitive prices. These policies can be purchased online without any medical reports.

| Country | India Diaspora (in lacs) |

| United States of America | 44.60 |

| Saudi Arabia | 32.55 |

| Malaysia | 29.75 |

| United Arab Emirates | 28.03 |

| Myanmar | 20.08 |

| United Kingdom | 18.25 |

| Sri Lanka | 16.14 |

| South Africa | 15.60 |

| Canada | 10.16 |

| Kuwait | 9.19 |

Senior Citizens (typically individuals above the age of 60 years) are beginning to travel the world in an attempt to explore destinations on their bucket list of places to see across the globe. This has created a new category of travellers, which the airline industry has seen growing to considerable numbers over the past decade. With increasing disposable income and willingness to spend their savings in return for a well-travelled holiday, airlines and hotels are looking to welcome these eager travellers. The Indian travel insurance industry is no exception. Almost all insurance companies have a separate customised travel insurance product catering to the senior traveller. A senior citizen travelling abroad, must ensure they have an insurance coverage in the first place. One should not risk travelling without an insurance coverage at any cost given that if there is any unforeseen emergency, medical or non-medical, the traveller could end up paying for the same from their pocket. Having an insurance plan with an Accident & Sickness (A&S) coverage between $50,000 and $100,000 (₹70,00,000) is reasonably sufficient cover per traveller to take care of a medical emergency. One important feature of the A&S coverage is the availability of Cashless Treatment in the case of inpatient hospitalisation. Apart from that the plan must have non-medical covers like Passport Loss, Baggage Delay/Loss, Trip Cancellation/Curtailment, Personal Liability etc.

Yes, there are travel insurance solutions for all age categories and one needs to input only the age of the traveller, destination and duration of travel, Sum insured for Accident & Sickness and a quote can be made available across all multiple India insurance providers. It is recommended that the insurance coverage for any traveller with advancing age be between $50,000 and $100,000 cover for Accident & Sickness. Based on the final plan opted for, the premium can be paid online and the certificate will reach the designated email id within a couple of minutes. Please note that your parent(s) need to be in India at the time of purchasing the insurance coverage.

Many Indian parents are now becoming more travel savvy and are willing to spend their hard earned savings on travel experiences across different countries in the world rather than having their money accumulate interest in the bank. Almost all countries have recorded a growth of inbound visitors in the age category 50-80 years and this is a welcome sign. Parents’ travel can be two fold. One is the more traditional form of travel where parents travel on long trips to US/UK/Europe/Australia etc to support their own children in raising their grandchildren while their children are both employed abroad. The second form of Parents’ Travel is where the parents would like to take a much needed international holiday for sightseeing or taking a break from their routine and these trips are funded by their savings or gifted to them by their children.

Acknowledging the fact that more senior people are travelling, many of the Indian insurance companies have come out with Senior Citizen insurance plans which specifically cater to travellers beyond the age of 60. Most of these plans do not have an entry age restriction, and so a senior citizen of any age can actually be covered under these insurance plans. When purchasing a Senior Citizen plan, one must ensure to buy a plan with a sum insured of atleast $100,000 of Accident & Sickness cover for each parent since the average claim for a senior citizen are almost double to claim amount of younger travellers.

| Parent’s Insurance Plan | |

|

Insurance Companies offering a comprehensive range of Senior Citizen plans. |

|

| The Parent’s insurance plan (like the Senior Citizen’s plan) is specifically for Senior citizens normally about the age of 50 years. It is a plan that focuses primarily on Emergency Accident & Sickness cover, but also has Medical Evacuation, Repatriation, Passport loss, Baggage Loss/Delay etc. | |

Coverages Offered

|

Policy Exclusions

|

Tips to find good and adequate international travel health insurance... Click here to read more

Comparison of overseas Healthcare cost and popular tourist destinations... Click here to read more

How to use Indian visitor insurance in case of sudden sickness and accidents... Click here to read more

Indian travel insurance for popular overseas tourist destinations... Click here to read more

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Know more »Insurance customers can renew their existing policy online before the exipry date at any time.

In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Know more »How to use Indian visitor insurance in case of sudden sickness and accidents

Know more »Comparison of overseas Healthcare cost and popular tourist destinations

Know more »Tips to find good and adequate international travel health insurance

Know more » Travel Insurance India

Travel Insurance India Senior Citizen Insurance

Senior Citizen Insurance Multi-trip Travel Insurance

Multi-trip Travel Insurance Schengen Travel Insurance

Schengen Travel Insurance Asia Travel Insurance

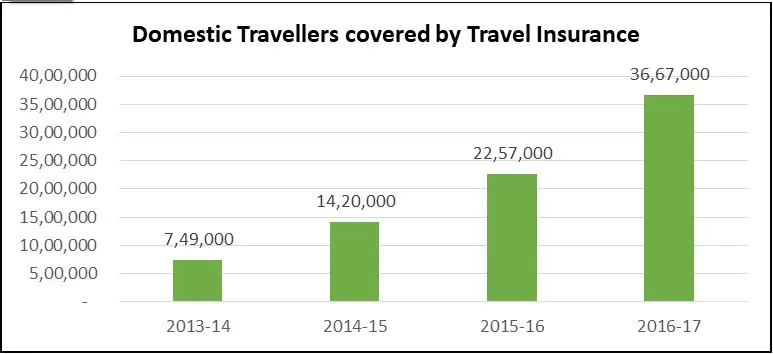

Asia Travel Insurance Domestic Travel Insurance

Domestic Travel Insurance Family Travel Insurance

Family Travel Insurance Student Travel Insurance

Student Travel Insurance