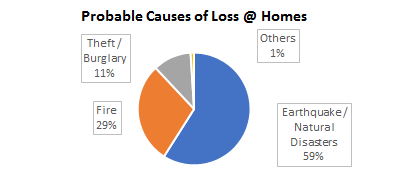

The frequency of natural disasters across many parts of India have been increasing dramatically over the past 7-10 years and the losses from such calamities are said to have reached over crores and crores of financial losses to home owners and other stakeholders.According to a recent study by the Natural Disaster Management Authority (NDMA) around 59 per cent of India’s land area is vulnerable to moderate or severe seismic hazard, implying that it is prone to shaking of MSK intensity VII and above. Also over 40 million hectares (12%) of its land is prone to floods and river erosion; close to 5,700 kms, out of the 7,516 kms long coastline is prone to cyclones and tsunamis; 68% of its cultivable area is vulnerable to droughts; and, its hilly areas are at risk from landslides and avalanches. Moreover, India is also vulnerable to Chemical, Biological, Radiological and Nuclear (CBRN) emergencies and other man-made disasters. Rapid, uncontrolled, unplanned urbanisation across all regions of India, continuous development even within high-risk zones, changing demographics, climate change compounded by reduction in biological diversity compounds the disaster risks in India.

A global study has pegged the economic loss to India at $ 79.5 billion (Rs. 55,650 crores) over the past 20 years only on account of Natural Disasters. Be it the past Chennai floods that claimed a total loss of over Rs.9,500 crore, or the 2013 North India floods that reported a loss of Rs.15,000 crore, India has been badly affected by Natural Disasters.

To reduce the burden of losses from disasters, there is an urgent need to increase home insurance penetration in the country. According to a FICCI report, only 11% of the total losses caused by floods in Mumbai, Surat and Uttarakhand were insured and here we are talking about relatively progressive cities/states.Further to that, according to Swiss Re’s 2015 Property Protection Gap study, India is among the most under insured countries relative to GDP, with penetration of property insurance as low as 0.07%, against 0.36% in Brazil and 0.23% in Russia. Home insurance accounts for only about 2% of the total premium collected by all General Insurance companies in India. And this is also on account of Financial Institutions mandating a home insurance for the purpose of mortgages being sanctioned.

Awareness about home insurance among the masses is very low. The few who understand do not consider buying insurance to protect their homes believing that nothing will happen to their homes and home insurance is an unnecessary cost to be borne.

A global study has pegged the economic loss to India at $ 79.5 billion (Rs. 55,650 crores) over the past 20 years only on account of Natural Disasters. Be it the past Chennai floods that claimed a total loss of over Rs.9,500 crore, or the 2013 North India floods that reported a loss of Rs.15,000 crore, India has been badly affected by Natural Disasters.

To reduce the burden of losses from disasters, there is an urgent need to increase home insurance penetration in the country. According to a FICCI report, only 11% of the total losses caused by floods in Mumbai, Surat and Uttarakhand were insured and here we are talking about relatively progressive cities/states.Further to that, according to Swiss Re’s 2015 Property Protection Gap study, India is among the most under insured countries relative to GDP, with penetration of property insurance as low as 0.07%, against 0.36% in Brazil and 0.23% in Russia. Home insurance accounts for only about 2% of the total premium collected by all General Insurance companies in India. And this is also on account of Financial Institutions mandating a home insurance for the purpose of mortgages being sanctioned.

Awareness about home insurance among the masses is very low. The few who understand do not consider buying insurance to protect their homes believing that nothing will happen to their homes and home insurance is an unnecessary cost to be borne.