Tips for buying best mediclaim insurance

India health insurance tips and tricks to choose the best medical insurance in India

Know more »

As humans, we are vulnerable to falling sick or getting a disease due to our hectic and stressful lifestyle. Sometimes even a minor change in weather can cause sickness. Health care of late is very expensive and more than the disease itself, it is often the cost of treatment that takes its toll on our peace of mind. The solution to these health related expense worries lies in having a good Health Insurance Policy which covers medical expenses incurred during pre and post hospitalization stages.

eindiainsurance is the best platform for you to compare various policies and the benefits offered by leading Insurance Companies in India and to buy the best suitable mediclaim policy online for your family and you.

So why wait? Compare and Buy a plan today and leave your health care worries to your Health Insurance policy..!!

As per the IRDA regulations on Health Insurance, the insurance companies should have an entry age restriction for Health insurance policies. Hence almost all the health insurance plans do not have any restriction in the entry age. This means that an insured of any age can purchase a health insurance policy.

Similarly, almost all plans come with a Lifelong Renewability feature (again directed by IRDA) and this ensures once an individual is enrolled with an insurer, they can renew their policy till they are alive, either with the same insurance company or port their policy. They only need to ensure payment of renewal premium within the stipulated timeframe to ensure timely renewals.

The free look period is the time period provided to the insured during which they can review the terms and conditions of their newly purchased health insurance policies and if not satisfied can terminate the policy without penalties, such as surrender/closure charges. A free look period normally lasts 14 or more days (depending on the insurer), allowing the insured to decide whether or not to keep the insurance policy; if he or she is not satisfied and wishes to cancel, the policy purchaser can receive a full refund.

Insurance policies are legal contracts that grant rights and responsibilities to both the insurance company and insured policyholder. Hence if the insured is not satisfied with the terms and conditions of the policy purchased, they can cancel and return the policy within this specified period after receiving it, and premiums will be fully refunded. During the free look period, the purchaser can continue to ask the insurer questions regarding the insurance policy contract in order to better understand the policy.

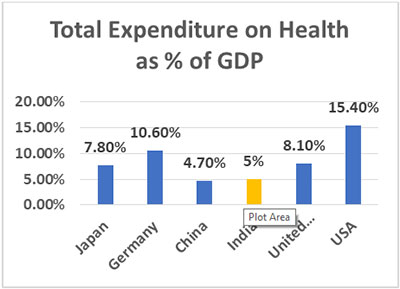

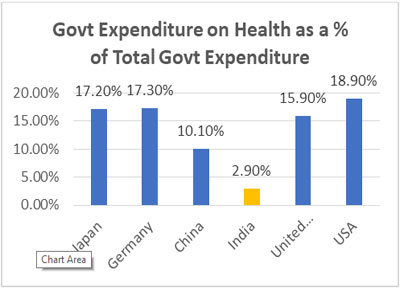

Health is a human right. It’s accessibility and affordability has to be ensured by the Government but the escalating cost of medical treatment is beyond the reach of common man especially in Tier II and Tier III cities (Rural areas). Health care has always been a problem area for India, a nation with a large population and larger percentage of this population living in urban slums and in rural area, below the poverty line. Under this situation, one of the ways for the government to reduce funding and augment the resources in the health sector was to encourage the development of health insurance. Currently (according to the Health Vertical Specialist team at Cognizant Technology) some of the challenges being faced in the Health Sector are :

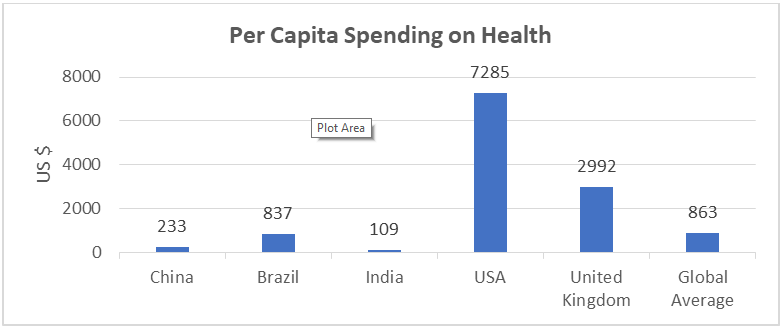

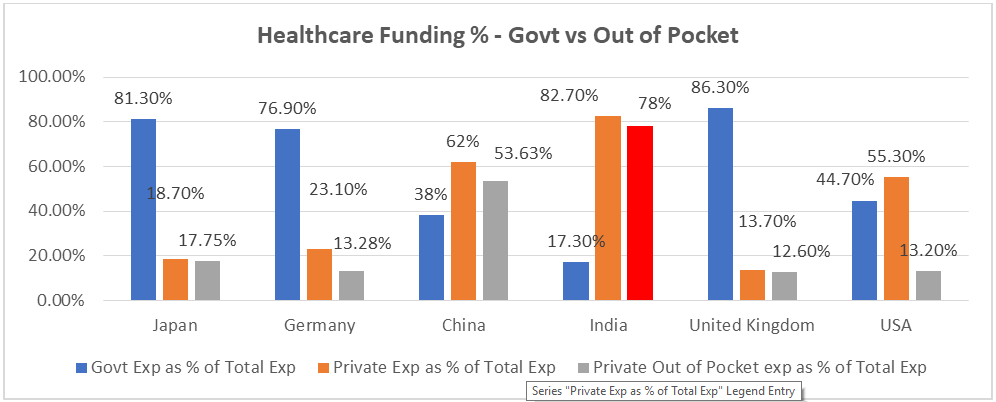

According to a detailed study by the Global Conference of Actuaries a few years ago, almost 78% of the Healthcare spend is borne Out of the Pocket of the individuals... this presents perhaps the biggest gaps that the Health Insurance players must fill aggressively over the next decade or so as well as being the biggest opportunity for Health Insurers and Distributors to capitalise upon…this is significantly higher than most developed nations across the world.

There are two possible scenarios possible if one is employed in India and the employer is providing a Health Insurance coverage. The employer could be providing a Group Health Insurance plan covering their employees and dependants or have an Individual Health insurance plan for each of their employees. Let us look at each scenario separately.

Group Insurance Plan Coverage of Employees – this is typically a family floater coverage for all the members of the family. In this case, if the employee is leaving the organization, he/she can approach the existing insurance company and request them to offer a family floater for the family with the same sum insured limits. The only difference in this case will be that the premium payable will be higher than the Group policy offered by the employer and hence the insured will need to agree to pay the higher premium. Secondly and importantly, the insured should request the insurer to provide a pre existing continuity benefit under the new plan. This will avoid the insured and his family going back to a 48 month pre existing waiting period. For example, if the employee was employed for 2 years and covered under the Group Plan of the Employer, then he/she can request the insurance company to continue the waiting period already crossed and hence under the new plan, the waiting period will only be 24 months, rather than starting from the first month and having a 48 month waiting period all over again.

Individual Insurance Plans for Employees –this is a far more easier option where all the insured will need to do is to apply for a portability of the existing policy to the same insurance company or another insurer. Assuming that the individual premiums earlier were being paid by the employer, the individual will now be required to pay the premium after leaving the organization. This same process holds good for the dependants also. Since the policies are ported from the earlier insurance plan, the pre existing waiting period continuity will be ensured.

The health insurance sector is easily one of the fastest growing segments in the insurance space in India. Ever increasing medical costs and increasing awareness levels are contributing to this growth, especially over the past few years. India is one of the most uninsured markets across the world with less than 20% of the population having some type of insurance coverage and in rural areas this falls to as low as 15%. Given this growth of health insurance, the industry is seeing significant changes in the range of plans which insurers are offering to customers. This is precisely why the IRDAI also offered licenses to insurance companies only focussed on Health Insurance, known as Standalone Health insurance companies (SAHI). These SAHI companies are leading the product innovation game and are at the forefront of unique product launches. So one shouldn’t be surprised to see a diabetes care or plans specially designed for cardiac patients. As mentioned earlier, the rising cost of medical treatments, inflation and the increased incidence of diseases (given the sedentary lifestyle) today have made health insurance a much needed insurance policy. A health insurance plan covers hospitalization expenses of the insured. Some of the more popular plans are :

This is clearly to most popular and preferred insurance policy. Also known as “Mediclaim” these policies compensate the policyholder by reimbursing the actual hospitalization costs incurred by him/her subject to a maximum opted Sum Insured. The word ‘indemnity’ means compensation for losses or damages and hence this plan covers hospitalization cost, pre and post hospitalization cost, expenses on surgeries, ambulance costs, etc. Under the Indemnity Plan, the insured can opt for an Individual Policy or a Family Floater policy depending on their requirement.

A top-up health insurance policy is an additional coverage for insureds who have an existing individual plan or a mediclaim provided by their employer. These plans increase the insured’s coverage amount at lower incremental premium costs. Top-up plans can be taken as supplementary plans for enhancing the coverage if the existing plan does not provide adequate coverage. Each top up plan has a deductible limit in the plan which is the minimum sum insured up to which the plan will not provide cover to the insured. If the claim exceeds the deductible limit, the plan is triggered and the excess claim amount above the deductible sum insured is paid.

Also known fixed benefit plans, they pay a specific fixed sum insured amount for a claim irrespective of the actual expense incurred by the insured. For instance, in the event of a Critical Illness, if the SI is ₹2 lacs, the policy will pay the insured ₹2 lacs on diagnosis of the Critical Illness irrespective of whether the insured spent ₹1 lac or ₹5 lacs for the treatment of the illness. Some benefit plans include:

These are specific plans offering coverages relating to only specific illnesses like Cardiac Care or Diabetes Care. So if a Diabetic wants to avail of a Health Insurance plan, regular plans will not offer coverage since diabetes will be treated as a pre existing condition. But under a Diabetes Plan, the insured even with a pre existing Diabetes condition will be offered coverage. Similar is the case for Cardiac Care. Persons with heart related complications can purchase this plan.

The health insurance policy is a type of insurance policy that covers your medical expenses in case of sickness or accident. A health insurance policy is a contract between an insurer and an individual /group in which the insurer agrees to provide specified health insurance cover at a particular “premium”.

Every individual should buy health insurance and for themselves and members of their family, based on their requirements. Buying health insurance protects individuals from the sudden, unexpected costs of hospitalization (or other covered health events, like critical illnesses) which would otherwise make a major dent into household savings. Each person is exposed to various health hazards and a medical emergency can strike anyone of us without any prior warning.

Healthcare is increasingly expensive, with technological advancements, new procedures and more effective medicines that have also driven up the costs of healthcare. While these high treatment expenses may be beyond the reach of many, taking the security of health insurance is much more affordable.

Today the Health insurance industry is flooded with various options to choose from. Under a vanilla Indemnity Plan Sum insureds ranging from Rs 5000 in micro-insurance policies to even a sum insured of Rs 50 lakhs or more in certain critical illness plans are being offered to individuals. Most insurers offer policies between 1 lakh to 5 lakh sum insured.

Also, while most non-life insurance companies offer health insurance policies for a duration of one year, there are policies that are issued for two, three, four and five years duration also. Another product, which is the Hospital Daily Cash Benefit policy, provides a fixed daily sum insured for each day of hospitalization.

A Critical Illness benefit policy provides a fixed lumpsum amount to the insured in case of diagnosis of a specified illness covered under the policy or on undergoing a specified surgery. There are also other types of products, which offer lumpsum payment on undergoing a specified surgery (Surgical Cash Benefit), and others catering to the needs of specified target audience like senior citizens.

The individual must read the prospectus/policy wordings (terms and conditions) to understand what is covered and not covered under the plan opted for. Generally, pre-existing diseases are excluded under a Health Insurance policy for the first 3-4 years.

There would generally be certain standard exclusions such as cost of spectacles, contact lenses and hearing aids, dental treatment/surgery, congenital defects, intentional self-injury / suicide, use of intoxicating drugs/alcohol, AIDS, treatment relating to pregnancy or child birth. Please read the policy terms and conditions.

Age is the most important factor that determines the premium, the older the person is, the premium cost will be higher because older persons are more prone to illnesses. Previous medical history is another major factor that influences the premium.

If no prior adverse medical history exists, premium will automatically be lower. Claim free years also come with certain percentage of discount on premium.

Some health insurance policies pay for specified expenses towards general health check up once in a few years. Normally this is available once in four years and is mainly offered as a value add to their corporate customers.

Insurance companies, through Third Party Administrators (TPA’s) have arrangements with several hospitals all over the country as their network to offer cashless treatment for individuals. This means that the insured can get treatment without having to pay the hospital bills as the payment is made to the hospital directly by the Third Party Administrator, on behalf of the insurance company.

However, expenses beyond the limits or sub-limits as per terms and conditions of the policy and expenses not covered under the policy have to be settled by the insured directly with the hospital. Cashless facility, however, is not generally available if you take treatment in a non network hospital.

Yes. When the insured buys a new policy, generally, there will be a 30 days waiting period starting from the policy inception date, during which period any hospitalization charges will not be payable by the insurer. However, this is not applicable to any emergency hospitalization occurring due to an accident. This waiting period will not be applicable for subsequent policies under renewal.

Yes. The Insurance Regulatory and Development Authority of India(IRDAI) has issued a circular in October, 2011, which allows the insurance companies to allow Portability from one insurance company to another and from one plan to another, without making the insured to lose the renewal benefits for pre-existing conditions, enjoyed in the previous policy.

Any number of claims are allowed during the policy period unless there is a specific cap prescribed in any policy. However the sum insured is the maximum limit under the policy.

The policy will be renewed provided the insured pays the premium within 15 days (called as Grace Period) from the date of renewal. However, coverage would not be available for the period for which no premium is received by the insurance company. The policy will lapse if the premium is not paid within the grace period.

Health insurance comes with attractive tax benefits as an added incentive. There is an exclusive section of the Income Tax Act which provides tax benefits for health insurance, which is Section 80D, and which is unlike the section 80C applicable to Life Insurance wherein other form of investments/ expenditure also qualify for the deduction. Currently, purchasers of health insurance who have purchased the policy by any payment mode other than cash can avail of an annual deduction of Rs. 15,000 from their taxable income for payment of Health Insurance premium for self, spouse and dependent children. For senior citizens, this deduction is higher, and is Rs. 20,000.

India health insurance tips and tricks to choose the best medical insurance in India

Know more »Find out the different reasons why a medical insurance claim is rejected, Cashless hospitalization, Reimbursement.

Know more »Factors for medical insurance in India, How much is the premium and the coverage offered by India health insurance plans.

Know more »You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Insurance customers can quickly compare the details of benefits offered under Indian mediclaim insurance policies.

Know more »Compare Indian health insurance policies, Health insurance India comparison.

Know more »Health insurance blogs - Information on health or medical insurance coverage in India.

Know more »FAQ related to Indian health insurance. Get answers for any health insurance questions.

Know more »Every individual must buy insurance and for themselves and members of their family, based on their requirements.

Know more »Family floater is one single policy that takes care of the hospitalization expenses of your entire family.

Know more »A typical Top Up Health Insurance plan is an additional coverage for an individual who is already covered under an existing Health policy.

Know more »Accident, is an unexpected event, typically sudden in nature and associated with injury, loss, or bodily harm.

Know more »