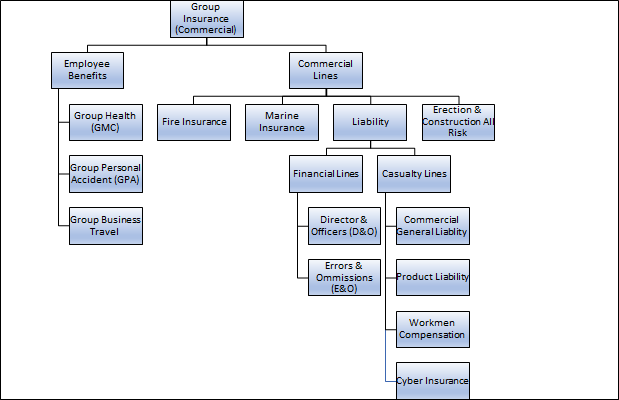

Some of the most common types of Commercial Insurance Policies are :

Property (of Fire) InsuranceThis is one of the most widely purchased commercial insurance policies. The policies cover damages to your commercial properties (office buildings, high rise homes). For instance, a fire or flood damaging your office/home space will be covered under such policies.

Employee Benefits Insurance

These policies will ideally provide Health and Personal Accident insurance cover to employees of organizations under policies known Group Mediclaim or Group Personal Accident plans or Group Term Life.

Marine (or Transit) Insurance

These policies deals with coverage for marine cargo risks during their transportation from one place to another (both domestic and international) for all types of industries such as oil and gas, paper and pulp, steel mills, manufacturing, food and beverages etc.

Liability Insurance

These policies are normally taken by large multi nationals looking to safeguard their business from large financial risks due to accusations of negligence brought against them by employees, clients, customers, shareholders, investors, or members of the public across all their operations worldwide. The policy will typically cover bodily or personal injury and property damage, product liability, product recall, workers’ compensation etc.

Shopkeeper’s Insurance

This type of policy is for smaller SME/MSME organisations and covers damage to shop buildings and contents, theft, burglary, cash insurance, personal accident, liability etc.

Cyber insurance

Cyber Insurance is an insurance product used to protect businesses and individual users from Internet-based risks, and more generally from risks relating to information technology infrastructure and activities. Coverage provided by cyber-insurance policies may include first-party coverage against losses such as data destruction, extortion, theft, hacking, and denial of service attacks; liability coverage indemnifying companies for losses to others caused.

Other Policies

Hulls of Ship and boats can be insured under Marine Hull Insurance. Further, there are specialized policies available such as Aviation Insurance Policy for insurance of planes and helicopters.