Get answers to all your questions?

Third Party Liability insurance is mandatory for all vehicles plying on public roads in India. This covers Liability for injuries and damages to others that you are responsible for. In addition, it is prudent to cover loss or damages to the vehicle itself by way of Comprehensive/Package policy, which covers both “Liability” as well as “Own damage” to the insured vehicle.

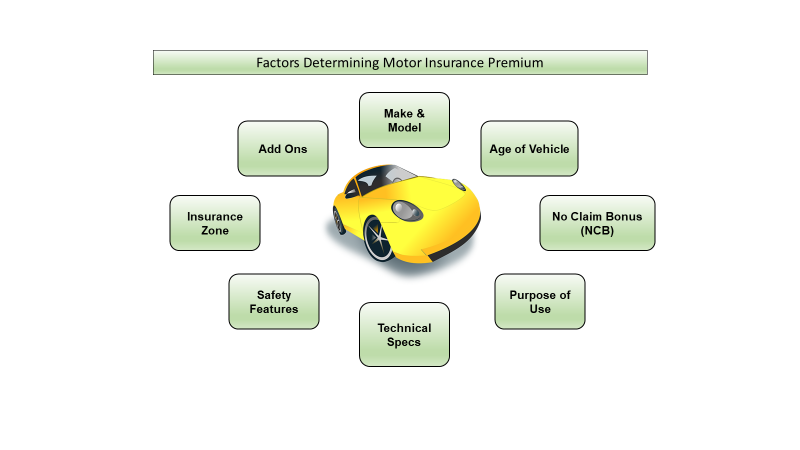

The same is determined on following factors amongst others -- Age of vehicle; Make& Model; No Claim Bonus; Safety Features etc. Third Party Liability Premium rates are laid down by IRDA. In case of break in insurance, vehicle inspection would be required and extra charges will have to be incurred for the same.

No Claim Bonus (NCB) is the benefit accrued to an insured driver for not making any claims during the previous policy period. As per current norms in India, it ranges from 20% on the Own Damage premium (and not on Liability premium) and progressively increases to a maximum of 50%. If, however, a claim is lodged, the No Claim Bonus is lost in the subsequent policy period. NCB is given to the insured and not to the insured vehicle. Hence, on transfer of the vehicle, the insurance policy can be transferred to new owner but not the NCB.

A motor policy is usually valid for a period of one year and has to be renewed before the due date without fail. Premium needs to be remitted to the insurance company prior to expiry of the policy. In case of lapse of policy by even one day, the vehicle has to be inspected. Moreover, if a comprehensive policy is allowed to lapse for more than 90 days, the accrued benefit of NCB (No Claim Bonus) is also lost

Deductible or "excess" is the amount over and above, which the claim will be payable. There is a normal standard/compulsory excess for most vehicles ranging from Rs 50 for two-wheelers to Rs 500 for Private Cars and Commercial Vehicles which increases depending upon the cubic capacity/carrying capacity of the vehicle. However, in some cases the insurer may impose additional excess depending upon the age of the vehicle or if there is high frequency of claims.

Yes, the insured can avail of the NCB facility if you change the insurer on renewal. You would have to produce proof of the NCB earned by way of renewal notice from the current insurer

For the purpose of applying premium rate, the place where the vehicle is registered is reckoned (not the place where the vehicle is used). If your vehicle is registered in Chennai, the rate applicable for Zone A is charged.

Generally, the following documents are required to be submitted. However, read through your policy to see the complete list—duly filled in claim form, RC copy of the vehicle, Original estimate of loss, Original repair invoice and payment receipt. In case cashless facility is availed, only repair invoice would need to be submitted and FIR, if required. For theft claims, the keys are to be submitted. Theft claims would also require non-traceable certificate to be submitted

As per Rule 141 of Central Motor Vehicle Rules 1989, a certificate of Insurance is to be issued only in Form 51. It is only in Motor Vehicle Insurance, apart from the policy, that a separate certificate of insurance is required to be issued by insurers. This document should always be carried in the vehicle

If a CNG / LPG kit is fitted in the vehicle, the (Road Transport Authority (RTA) office where the vehicle was registered should be informed so that they make a note of the change in the registration certificate (RC) of the vehicle.

Yes, the insurance can be transferred to the buyer of the vehicle, provided the seller informs in writing of such transfer to the insurance company. A fresh proposal form needs to be filled in. There is a nominal fee charged for transfer of insurance along with pro-rata recovery of NCB from the date of transfer till policy expiry. It may be noted that transfer of ownership in comprehensive/package policies has to be recorded within 14 days from date of transfer failing which no claim will be payable for own damage to the vehicle.