Tips to find best travel insurance

Tips to find good and adequate international travel health insurance.

Know more »Travel insurance for the UK from India provides comprehensive financial protection for travelers against high medical costs and a range of travel-related risks. These plans typically include coverage for emergency medical expenses, hospitalisation, personal accidents, medical evacuation, repatriation of remains, trip delays or cancellations, loss or delay of baggage, loss of passport, and in many cases, limited coverage for pre-existing conditions.

Travel insurance plans for the UK from India are available at affordable daily rates, starting from approximately ₹18 per day. Prices depend on factors such as traveler age, trip duration, and coverage limits. Travelers are advised to compare multiple UK travel insurance plans to select the one that meets their visa requirements and provides adequate medical coverage.

Looking for the best travel medical insurance for UK? Here's a curated list of the top 5 travel insurance plans for UK.

UK travel insurance cost starts from ₹908 for 35 years old traveler with medical maximum of $50,000 depending on the age, the insurance company. Some of the best travel insurance for UK from India listed below meet the UK requirements and are widely recognized by embassies and consulates.

| Insurance Company | Plan Name | Age 35 | Age 55 | Age 65 | Age 75 | Age 85 |

|---|---|---|---|---|---|---|

| Bajaj General | Travel Companion Care Plan | ₹908 | ₹1,050 | ₹1,868 | ₹3,842 | ₹6,691 |

| Care ( Religare ) | Explore Gold | ₹992 | ₹1,350 | ₹2,379 | ₹2,699 | ₹4,003 |

| Tata AIG | Travel Guard Plus Silver Plan | ₹1,002 | ₹1,242 | ₹2,435 | ₹4,953 | ₹11,810 |

| Reliance | Travel Care Standard | ₹1,027 | ₹1,173 | ₹2,058 | ₹2,058 | ₹6,482 |

| Royal Sundaram | Travel Classic | ₹1,163 | ₹1,366 | ₹3,025 | ₹5,475 | ₹9,536 |

Travel insurance is one of the most important financial protections for international travellers. In case of hospitalization, emergency treatment, or non-medical issues abroad, insurance ensures immediate assistance and peace of mind.

Compare free quotes from leading insurers and buy your plan online in just minutes.

Explore PlansNo hidden fees or extra charges on services at eindiainsurance.

Instant quotes and easy comparison to pick your best option.

Enroll in under 3 minutes with just your premium payment.

Compare and buy at the most competitive premiums available.

What our happy customers have to say about us

"I felt happy to have a travel insurance from you. I can easily compare with all the companies and based on my requirement I can select the required one."

"This to convey our gratitude to your customer support team for having guided us very well in procuring our overseas travel insurance."

"Thank you very much for the cooperation and support as per the request made with updated dates on the policy issued. Appreciate it."

242,495 km²

London

Pound sterling (GBP)

Summer (June–August) or Winter (December–February)

~68 million (6.8 crores)

English (Welsh and Scottish Gaelic in some regions)

London, Cornwall, The Lake District, Scottish Highlands, Big Ben, River Thames, London Eye, Stonehenge

London, the capital of England and the United Kingdom, is a 21st-century city with history stretching back to Roman times.

Stonehenge is composed of earthworks surrounding a circular setting of large standing stones in south west England.

Edinburgh is the capital city of Scotland and one of its 32 council areas. It is second most populous city and the seventh most populous in the United Kingdom.

The Lake District, also known as the Lakes or Lakeland, is a mountainous region in North West England. It it is famous for its lakes, forests and mountains.

Travelling overseas can be enjoyable if planned in an effective way. In UK where the cost of living, health care cost and other expenses is extremely high and any emergency situation can lead to huge financial crisis. Buying the best travel insurance from India for travelling to UK can help you help you have hassle free trip.

Indians visit UK for few days, weeks or up to many months and Indians must ensure that they have adequate overseas mediclaim insurance for the entire period of stay. As travellers are exposed to a different environment, there are high chances of unexpected sickness or any sort of sudden travel emergency like trip delay, passport loss, baggage loss or delay.

Don’t worry! the international travel insurance for visitors from India to UK would cover most of the expenses arising from exigencies. Parents and Senior citizen travellers from India are more prone to medical and trip risks and they cannot risk travelling to UK without good and suitable travel insurance from India. Also majority of these travellers who have an existing ailment can buy coverage for pre-existing medical conditions suitable for them.

The United Kingdom(UK) that comprises England, Wales, Scotland and Northern Ireland has always been one of the most popular destination countries for an Indian Traveller. With so many wonderful sights and historical places to visit, a trip to UK can never have a dull moment in it.

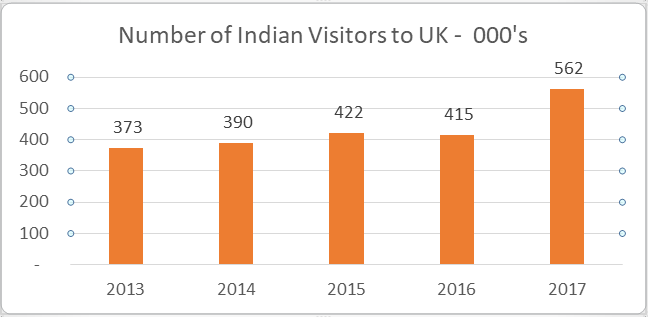

The Indian visitors have been growing every significantly over the years and in 2017 there were 5,62,000 Indian tourists who visited UK according to the data published by the Visit Britain website. This is a massive 35% growth over 2016 which clearly illustrates how popular UK is getting as a favoured tourist destination for the Indian traveller.

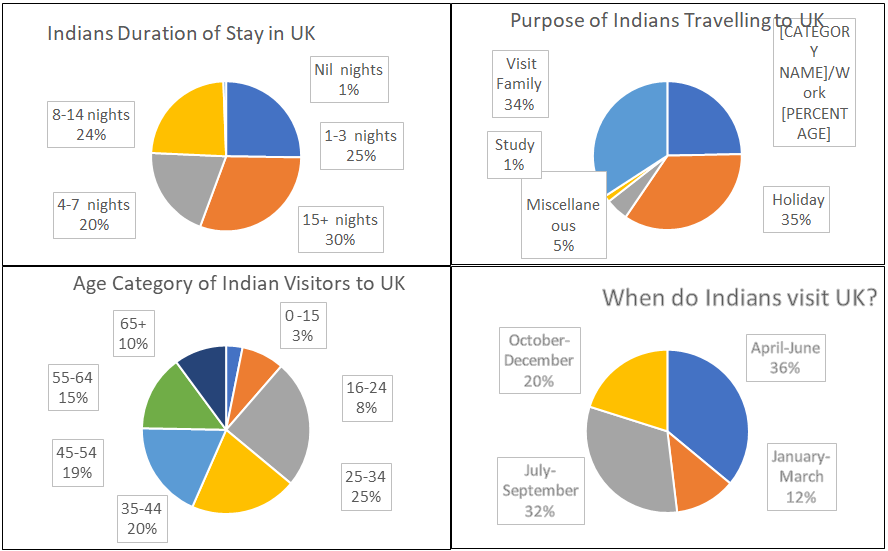

There are some other interesting data shared on the Indian traveller by the website in its study, which is tabled below.

There are some other interesting data shared on the Indian traveller by the website in its study, which is tabled below.

It is important to note that eventhough the cost of medical treatment in the UK is not as costly as it is in the US, there is a significant difference when compared to India. According to Indian Medical Tourism data, tabled below, it is clearly demonstrated that the Indian traveller must insure themselves with travel health insurance for UK to ensure they are not placed in any financial difficulties when hit with an unexpected serious illness/hospitalisation.

There are many insurance plan options that a traveller can choose from for their trip to UK. The first and most important fact to be considered is the cost of healthcare in UK. After USA, the UK is one of the countries where the healthcare costs are relatively very high for an Indian traveller. This is demonstrated in the table below.

| Procedure | UK ($) Approx | India ($) Approx | India ₹ INR |

|---|---|---|---|

| Open Heart Surgery /Bypass Surgery | $24,000 | $8,000 | 5,60,000 |

| Facial Surgery and Skull base | $13,000 | $4,500 | 3,15,000 |

| Neurosurgery with Hypothermia | $21,000 | $6,800 | 4,76,000 |

| Complex spine surgery with implants | $13,000 | $4,600 | 3,22,000 |

| Hip Replacement | $13,000 | $4,500 | 3,15,000 |

| Simple Spine Surgery | $6500 | $2,300 | 1,61,000 |

| Simple Brain Tumor | |||

| Biopsy | $4,300 | $1,200 | 84,000 |

| Surgery | $10,000 | $4,600 | 3,22,000 |

This makes it critical and highly recommended that all travellers travel to UK with an insurance plan at all costs. Given the current exchange rates of the GBP (£) against INR (₹), it is advisable that the insured has a sum insured of atleast $250,000 to $500,000.

The Indian insurers today offer comprehensive travel medical insurance UK plans. UK visitor insurance coverage include Accident & Sickness, Dental Cover, Medical Evacuation and Person Accident among the Medical coverages and Loss of Baggage/Passport, Trip Cancellation/Curtailment among the Non Medical covers. These are offered at very competitive premiums as well when compared to purchasing an inbound insurance policy from a UK based insurance company.

Tips to find good and adequate international travel health insurance.

Know more »Comparison of overseas Healthcare cost and popular tourist destinations.

Know more »How to use visitor insurance in case of sudden sickness and accidents.

Know more »Visa free countries for Indians - Check, list of visa free countries where Indian passport holders can travel without visa.

Know more »Indian passport holders have the benefit of visa on arrival in different countries – find travel insurance suitable for visa on arrival.

Know more »You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Know more »Insurance customers can renew their existing policy online before the exipry date at any time.

Know more »In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Know more »Tips on Air Travel – Safety, Comfort and Wellness. Air travel tips for first time.

Know more »Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Know more »How to use Indian visitor insurance in case of sudden sickness and accidents

Know more »Comparison of healthcare cost in Indian and other popular Indian tourist destinations

Know more »Tips to find good and adequate international travel insurance from finest insurance companies in India

Know more »