Universities Worldwide

Indian Student Insurance for popular international universities

Know more »Yes, it is mandatory for all International students (including Indian students) going abroad for their higher studies to have an insurance cover. This mandatory cover is applicable to all Universities/Colleges across the world. Almost all Universities/Colleges have their own Health Insurance offerings for the students enrolling in their courses, but it is not mandatory for the student to avail only the University/College Plans. The Indian insurance company offerings are comparable to the University/College plans in terms in coverage and much more competitive in terms of premium and hence all Indian students should review the Student Health insurance plans from the Indian insurers before making a final decision regarding the same.

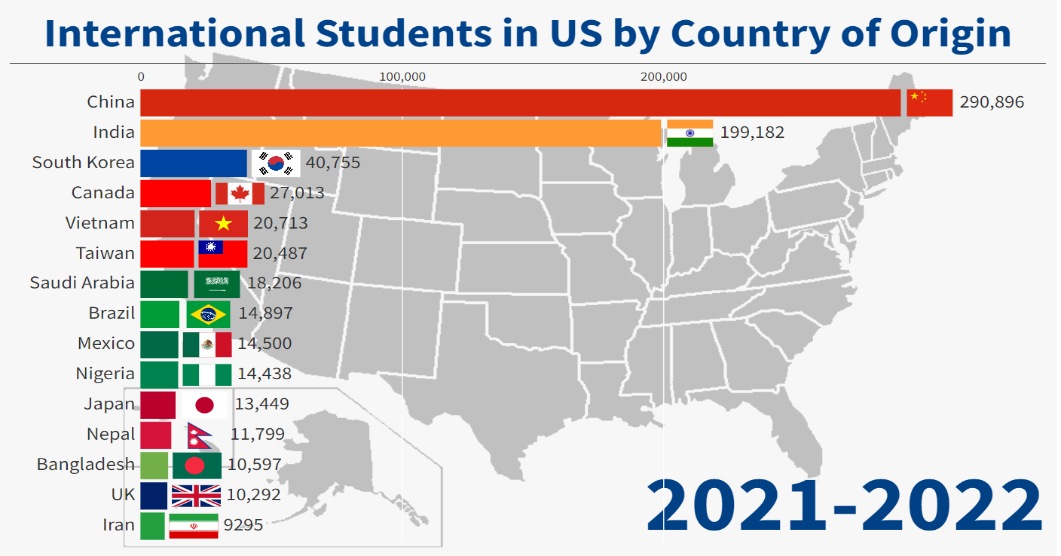

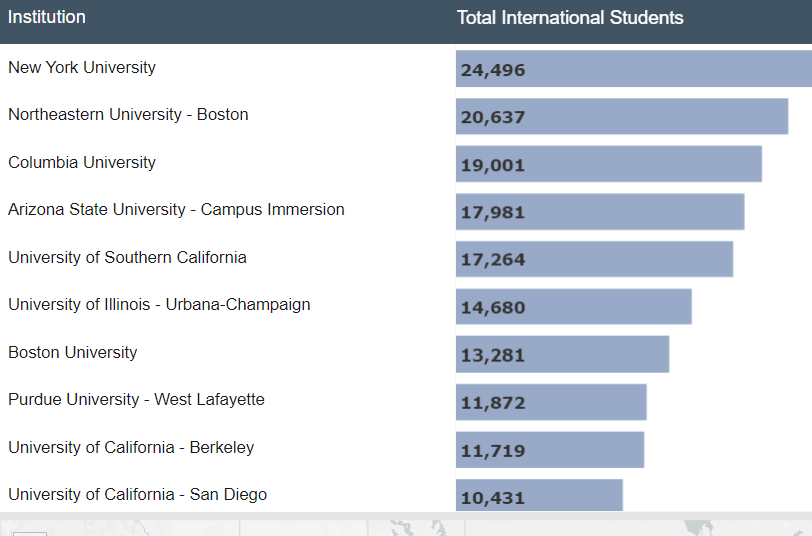

India ranks second globally in the number of international students, reflecting the strong academic drive among Indian students and the allure of quality education abroad for advancing career prospects. Many Indian graduates of prestigious international institutions have gone on to lead major global companies. Studying abroad not only broadens horizons but also opens up promising career opportunities. Beyond academics, students explore new cultures and surroundings, enriching their educational experience.

As of recent data from the Ministry of External Affairs, Government of India, approximately 550,000 Indian students are studying in 86 countries worldwide, across various universities and academic years. . Around 50% of these students choose North America, particularly the United States, for higher education, with annual growth rates averaging 7-8%. The distribution among countries varies widely, with some hosting fewer than 100 students while others, like the USA and China, hosting tens of thousands.

| Open doors report data | 2021/22 | 2022/23 | %increase |

|---|---|---|---|

| Indian international students in United States | 199,182 | 268,923 | 35% |

| Undergraduate students | 27,545 | 31,954 | 16% |

| Graduate students | 102,024 | 165,936 | 62.6% |

| OPT | 68,188 | 69,062 | 1.3% |

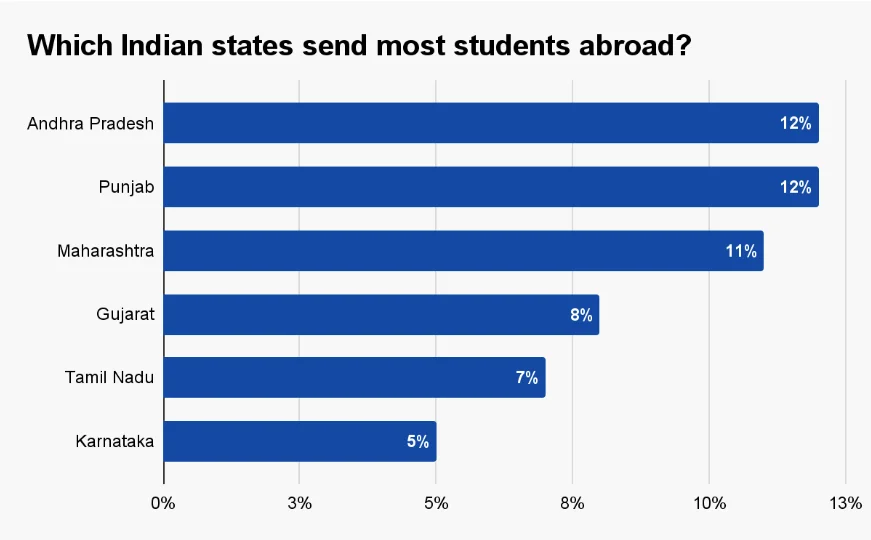

Notably, the majority of students originate from a handful of cities and states, with Andhra Pradesh and Telangana accounting for a significant portion.

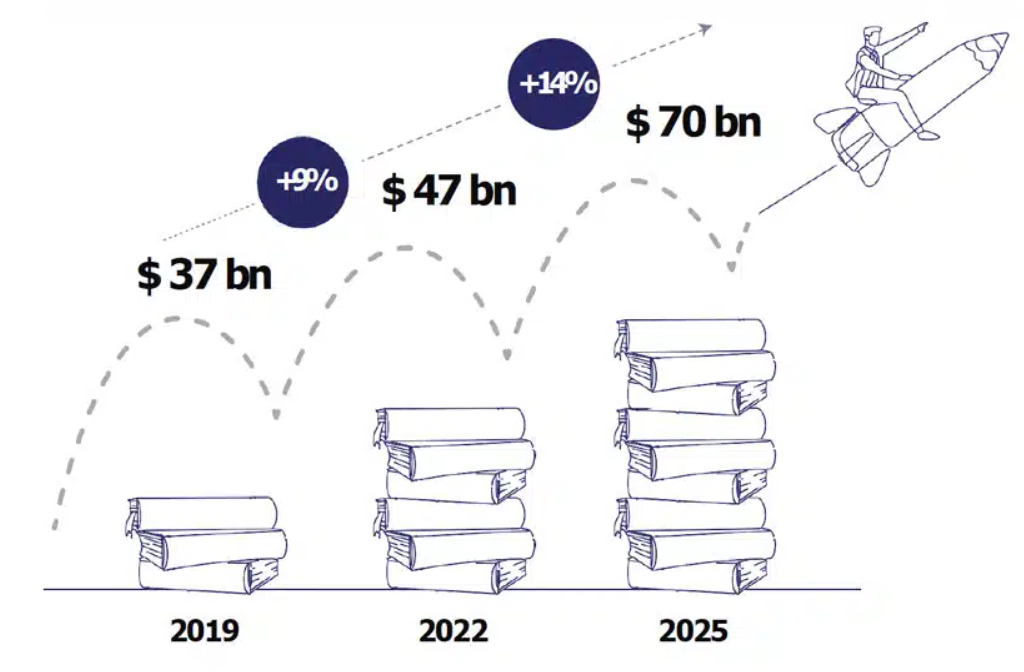

While studying abroad is a substantial financial commitment for most families, the expenditure continues to rise annually, and is expected to touch an unprecedented $70 billion by 2025. This covers tuition, accommodation, and other incidental expenses abroad. Despite the costs, the USA remains a primary destination, with nearly 200,000 Indian students studying there annually, second only to China.

Medical emergencies or unexpected incidents can occur during students overseas stays, underscoring the importance of comprehensive student medical insurance.

Although many universities offer local insurance plans, Indian insurers provide comparable coverage at more affordable premiums, payable in Indian Rupees but covering expenses in US Dollars.

Such insurance not only covers medical expenses but also includes provisions such as bail bonds for situations like arrest or detention abroad due to bailable offenses.

In conclusion, while pursuing education abroad offers immense opportunities, it's crucial for students to safeguard themselves with reliable insurance coverage. This ensures that they can focus on their studies and personal growth without the worry of unforeseen financial or medical crises.

Student Insurance is an insurance policy that any student between the ages of 16-40 (depending on the insurance company opted for) can purchase while travelling abroad to pursue their higher studies at a foreign College/University. Today insurance coverage is available at competitive premiums primarily depending on

Student Insurance policies from India insurers are very competitively priced when compared to the insurance plans offered to the student by the College/University. (For example for a 25 year old student going to USA for higher studies for a period of 1 year (365 days), the insurance premium across multiple products from Indian insurance companies ranges from ₹ 26,000 to ₹ 44,000 for the whole trip – this is for a coverage of USD $500,000 which is around ₹ 3.40 cr for Accident & Sickness. If we take the average cost of 1 years fee to be around ₹8,00,000, then the insurance premium contribution is just 3.2%. These premiums will be even lower when the student is visiting any other country in Europe, UK, Australia, Asia etc.). It is important to note that apart from Accident & Sickness the plans also have many relevant benefits for students like Compassionate Visit, Sponsor Protection, Study Interruption, Cancer Screening & Mammography, Maternity Coverage etc. Students should ideally compare the Indian Insurance plans vis-à-vis what the College/University is offering before making a decision. Indian Insurance plans also offer cashless treatment if the student is seeking inpatient treatment for an accident or sickness. If the student is indeed travelling with an Indian Student insurance plan, and the College/University needs an Insurance waiver form to be submitted, the same can be provided by the India insurer. Hence it is strongly recommended that every student buys a student insurance policy before leaving India.

Yes, student health insurance is necessary for all students planning on pursuing their studies abroad. This is mandatory irrespective of which College/University the student is joining anywhere in the world. Apart from the fact that student health insurance is mandatory, it is advisable for the student to protect themselves financially from any unexpected exigencies (both medical and non medical) that can occur while they are abroad. Under the Medical cover, the student is protected against Accident & Sickness expenses, Personal Accident, Medical Evacuation and Repatriation while Non Medical coverages include Maternity Coverage, Study Interruption, Compassionate Visit, Sponsor Protection, Cancer Screening & Mammography etc. Since the students are anyways spending a reasonably high sum of their parent’s money (either savings or through educational loans), it is prudent to spend 3-4% more and protect themselves against any untoward incident. Being insured also allows the student to remain stress free and focus on their studies.

International Student Health insurance is a comprehensive student insurance plan that all students should have in place before they travel abroad to pursue their higher education. The coverage should have a stipulated coverage for Accident & Sickness Expense cover and some other mandatory benefit coverages in place. While currently most India students are opting for purchasing these policies from their respective Colleges/Universities, the Indian insurance companies also offer comprehensive insurance plans with benefits that match the College/University requirements (and sometimes exceed the same). Students are expected to have coverages for Accident & Sickness, Sponsor Protection, Cancer Screening, Maternity, Mental & Nervous Disorders, Personal Liability etc and most Indian insurance plans offer the same. The Indian insurance plans while being comparable on benefits are also extremely competitively priced with the premium being relatively lower than the premiums offered under the College/University plans. The Indian student health plans also offer cashless treatment for inpatient sickness and accident coverage.

Some of the unique coverages include:

Only Inpatient Medical expenses related to pregnancy, termination of pregnancy only as a result of physician’s advice to terminate pregnancy due to medical reasons and not due to insured person’s choice to terminate pregnancy subject to waiting period of 10 months

Medical expenses related to treatment for mental and nervous disorders, including alcoholism and drug dependency are covered subject to maximum amount as provided in the schedule of benefits

Medical expenses due to Pre-existing Condition in case of Life threatening unforeseen emergency subject to maximum amount as provided in the schedule of benefits. In such event, measures solely designed to relieve acute pain, provided to the Insured by the Physician for Disease/accident arising out of a pre-existing condition would be reimbursed. The treatment for these emergency measures would be paid till the insured becomes medically stable or is relieved from acute pain

Medical Expenses related to Cancer Screening and Mammographic examination on recommendation from a physician is covered subject to maximum amount as provided in the schedule of benefits. Any tests done as a part of preventive health check-up are not included under this benefit

For ongoing physiotherapy to treat a disablement due to an accident, unless this is recommended in writing by the treating registered medical practitioner, upto the amount as stated in the policy schedule

Childcare benefits – We will pay upto the maximum amount as provided in the schedule of benefits, if the child is in between the age of 7 days - 90 days, and is hospitalized for 2 days or more for any ailment.

Yes, off course all International students need to have a health insurance plan in place for two reasons : i) the University/Colleges insist on a mandatory insurance coverage during the duration of the study and ii) it is advisable that the student remains protected against any unexpected emergency and having an insurance cover becomes critical. But it is important for the student to have adequate protection not only from Medical emergencies like Accident & Sickness (A&S) but also Non Medical emergencies and this is where the Indian Student Health Insurance plans come in. Today apart from A&S coverage, the Indian Insurance plans also offer coverage for Loss of Passport, Baggage Delay/Loss, Sponsor Protection, Study Interruption, Maternity Coverage, Cover for Mental & Nervous Disorders, Compassionate Visit etc. These non-medical coverages are also relevant to a student venturing abroad for the first time for their studies. Hence it is strongly suggested that the Indian students/parents review the Indian Student Health insurance plans before making a final decision.

| Insurance Companies offering student medical insurance | |

|---|---|

| Student Travel Insurance is an insurance policy specifically designed for students travelling abroad on student visa to pursue their higher studies. The policy covers students who are enrolling in colleges, universities or institutes in a foreign country for professional/other academic courses. There are coverages specific to students that include Sponsor Protection, Compassionate Visit , Bail Bond and Study Interruption. | |

| Coverages Offered | Policy Exclusions |

|

|

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Student medical insurance for Indian students already outside India.

Know more »Insurance customers can renew their existing policy online before the exipry date at any time.

Know more »Popular overseas travel insurance for Indian tourists and students abroad

Know more »