Universities Worldwide

Indian Student Insurance for popular international universities

Know more »

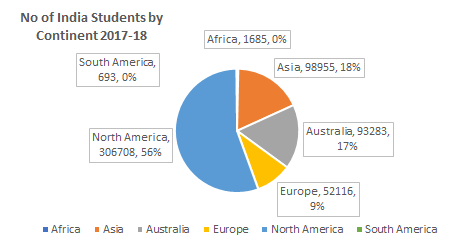

When the same information is presented by continent (as seen below), it can be seen that 56% of Indian students are opting for US and Canadian Universities while Asian (China, Bahrain, Philippines) and Australian (Australia & New Zealand) Universities are a significantly lower contribution of around 100,000 students each

Yes, it is mandatory for all students proposing to go abroad for their higher education to any College/University to have a health insurance plan in place. No student will be enrolled into the College/University without confirming coverage under a health insurance plan which meets the University Minimum Health requirements. Currently all students bound for Colleges/Universities abroad have an option to buy the insurance plan through the College/University or purchase the same from an Indian insurance company prior to travelling abroad. While there is a preference for the Indian students to but the policy offered by the Educational Institution, the Indian insurance companies also do offer comprehensive student insurance solutions for the discerning student traveller. One can opt for the Indian insurance plans since they offer more comprehensive coverages at lower premiums that their foreign insurance counterparts (through the College/University). Indian insurance companies offer Accident & Sickness expenses, Personal Accident, Medical Evacuation and Repatriation while Non Medical coverages include Maternity Coverage, Study Interruption, Compassionate Visit, Sponsor Protection, Cancer Screening & Mammography as some of the key coverages under their student insurance plans.

Most Colleges/Universities have their own arrangements in partnership with local insurance companies to offer Student health insurance plans for the students enrolling in their institution. This is in line with the Minimum Health requirements of the particular state/territory and all student policies must comply with these requirements. Indian insurance companies also offer student health insurance plans with comparable benefits to the Minimum Health requirements and these coverages are offered at very competitive premiums as well. Students traveling abroad should know that they can purchase the Indian insurance plans as long as they meet the Minimum Health Requirements laid down by the College/University and should buy this policy before leaving India. Indian insurers also offer a long term 2/3 year duration student health insurance plan to cover the entire duration of their study abroad. Most of the Indian insurance plans cover Accident & Sickness, Sponsor Protection, Cancer Screening, Maternity, Mental & Nervous Disorders, Personal Liability.

| Insurance Companies offering student medical insurance | |

|---|---|

| Student Travel Insurance is an insurance policy specifically designed for students travelling abroad on student visa to pursue their higher studies. The policy covers students who are enrolling in colleges, universities or institutes in a foreign country for professional/other academic courses. There are coverages specific to students that include Sponsor Protection, Compassionate Visit , Bail Bond and Study Interruption. | |

| Coverages Offered | Policy Exclusions |

|

|

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Student medical insurance for Indian students already outside India.

Know more »Insurance customers can renew their existing policy online before the exipry date at any time.

Know more »Popular overseas travel insurance for Indian tourists and students abroad

Know more »