Tips to find best travel insurance

Tips to find good and adequate international travel health insurance.

Know more »All travel insurance companies do offer direct/cashless settlement to hospitals for inpatient treatment for Accident of Sickness expenses incurred by the insured traveler. Direct settlement is more often referred to as cashless settlement or payment and is the process where the insurance company issues a Guarantee of Payment (GOP) letter to the medical institution (Hospital) confirming coverage for the insured against the treatment being availed by the insured. This GOP is issued to the hospital after the insurance company/its TPA confirms that the insured does have a valid policy and the treatment/ailment is actually covered under the scope of the policy terms and conditions

It is important for the insured / family member of the insured to inform the Assistance Company/TPA as soon as the insured is admitted to the hospital for treatment to ensure they don’t end up spending any money from their pocket except the deductible payable for every claim. The Assistance Company/TPA Toll Free contact numbers/email ids are printed on the insurance certificate and they can be reached for any Assistance. Kindly note that it is important to also have the Policy Certificate number handy to inform the Assistance company regarding a claim.

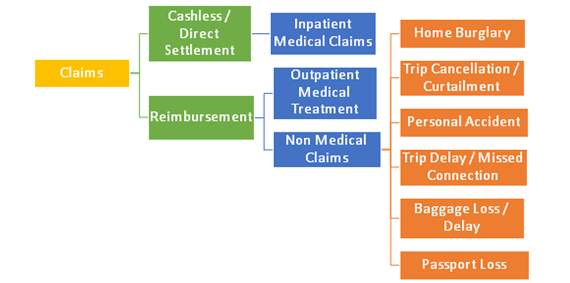

There are two types of claims that an insured can file under a Travel Insurance policy. The first is a Cashless/Direct Settlement claim which is typically for Inpatient treatment for Accident & Sickness Medical expense claims.

The other type of claims are Reimbursement claims where the upfront expenses are incurred by the insured and then a reimbursement is sought from the Insurance company. Reimbursement claim are usually for Outpatient Medical Expense claims and for Non Medical claims like Passport Loss, Baggage Delay/Loss, Trip Delay, Missed Connection, Personal Accident etc. They can also be for any minor treatment like a fever/cold/cough etc where the expenses incurred are not very high. Here the insured is required to retain bills, receipts, documents pertaining to the expenses incurred and then submit the same to the insurance company on their return to India. The documents are submitted along with a claim form which narrates the type of loss incurred and other information including bank details, policy details etc. All insurance companies reimburse these claims against the documents submitted in a standard outer timeframe of 14 working days subject to policy terms and conditions.

Each Assistance Company has their own network of hospitals throughout the world and the insured can reach out to these hospitals/medical facilities through the Assistance company. The recommended process is as follows:

Hence it is important that the insured traveller uses the presence of the Assistance Company/TPA abroad and their network of hospitals for the best quality medical care.

Tips to find good and adequate international travel health insurance.

Know more »Comparison of overseas Healthcare cost and popular tourist destinations.

Know more »How to use visitor insurance in case of sudden sickness and accidents.

Know more »Visa free countries for Indians - Check, list of visa free countries where Indian passport holders can travel without visa.

Know more »Indian passport holders have the benefit of visa on arrival in different countries – find travel insurance suitable for visa on arrival.

Know more »You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Know more »Insurance customers can renew their existing policy online before the exipry date at any time.

Know more »In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Know more »Tips on Air Travel – Safety, Comfort and Wellness. Air travel tips for first time.

Know more »Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Know more »How to use Indian visitor insurance in case of sudden sickness and accidents

Know more »Comparison of healthcare cost in Indian and other popular Indian tourist destinations

Know more »Tips to find good and adequate international travel insurance from finest insurance companies in India

Know more »