Tips for buying best mediclaim insurance

India health insurance tips and tricks to choose the best medical insurance in India

Know more » Niva Bupa Health Premia insurance

Niva Bupa Health Premia insurance

Health Premia is a Comprehensive health insurance plan, it provides the perfect coverange for you and for your family according to your needs and lifestyle. International coverage for specified illness and medical emergencies. Health Premia ensures that you get the best in healthcare. Comprehensive coverage up to 3 crore.

3 lac - 300 lacs options available

8.0%

88%

23,330

23,330

1 year options available

8,600+ hospitals

Self, Spouse + 4 dependent children

| PERIOD ON RISK | RATE OF PREMIUM TO BE CHARGED |

|---|---|

| Up to 15 days | Full policy premium refundable |

| Up to one-month | 1/3rd of the policy premium |

| Up to three months | 1/2nd of the policy premium |

| Up to six months | 3/4th of the policy premium |

| Exceeding six months | Full policy premium |

A waiting period is the length of time you, the insured, will have to wait before the benefits under the health policy can be utilised.

A ‘Free Look Period’ is a period of 15 days from the date of receipt of the policy that a policyholder, in this case you, have to review the entire health insurance plan. If you disagree with any of the terms or conditions mentioned in the policy, you have the option of returning the policy by stating the reasons for the objection. Following this, you are entitled to a refund of the premium paid, provided no claim has been made under this mediclaim insurance policy (subject only to a deduction of the expenses incurred by the company on medical examination and the stamp duty charges). Please note that this facility is not applicable on renewal and portability cases.

A grace period refers to a period of 30 days immediately following the premium due date of the medical insurance policy. During this period you can pay the premium of your expired policy and avail continuity benefits such as waiting periods and coverage of pre-existing disease.

Hospital cash is a daily benefit which provides the insured person with a lump sum amount in case of hospitalisation. You can use the money for meeting additional expenses or for compensating the loss of income during the period of hospitalisation.

Review Niva Bupa Health Premia brochure to understand coverage details.

Know more »Review Health Premia policy wordings which explains the terms and conditions.

Know more »Review and compare the best health insurance.

You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Insurance customers can quickly compare the details of benefits offered under Indian mediclaim insurance policies.

Know more »Compare Indian health insurance policies, Health insurance India comparison.

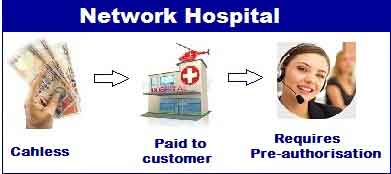

Know more »Niva bupa health insurance network hospitals list. Cashless & Hassle-free direct claim settlement with us at 6,900+ Hospitals

Know more »FAQ related to Indian health insurance. Get answers for any health insurance questions.

Know more »India health insurance tips and tricks to choose the best medical insurance in India

Know more »Find out the different reasons why a medical insurance claim is rejected, Cashless hospitalization, Reimbursement.

Know more »Factors for medical insurance in India, How much is the premium and the coverage offered by India health insurance plans.

Know more »