Tips for buying best mediclaim insurance

India health insurance tips and tricks to choose the best medical insurance in India

Know more » Niva Bupa Health Companion insurance

Niva Bupa Health Companion insurance

Health care is very expensive nowadays. More than the disease itself, it is often the cost of treatment that takes its toll. Health insurance policy covers medical expenses incurred during pre and post hospitalisation stages. Buy Indian health insurance policy for you and your family and get rid of health care expense worries.

3 lac - 300 lacs options available

8.0%

88%

23,330

23,330

1 year options available

8,600+ hospitals

Self, Spouse + 4 dependent children

| Benefits | Niva bupa health companion Variant 1 | Niva bupa health companion Variant 2 | Niva bupa health companion Variant 3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 Lacs | 3 Lacs | 4 Lacs | 5 Lacs | 7.5 Lacs | 10 Lacs | 12.5 Lacs | 15 Lacs | 20 Lacs | 30 Lacs | 50 Lacs | 100 Lacs | |

| Benefits | ||||||||||||

| In-patient treatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Room Rent | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Pre hosptitalization medical expenses (30 days) | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Post hosptitalization medical expenses (60 days) | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Day Care tTreatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Living Organ Donor Transplant | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Emergency Ambulance | Up to 3,000 | Up to 3,000 | Up to 3,000 | |||||||||

| No Claim Bonus | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | |||||||||

| Refil Benefit* | Up to Base Sum Insured | Up to Base Sum Insured | Up to Base Sum Insured | |||||||||

| Vacination for Animal Bite** | Up to 2,500 | Up to 5,000 | Up to 7,500 | |||||||||

| Alternate Treatments | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Health Check-up | Once in 2 years, as per Annexure | Annual, as per Annexure | Annual, as per Annexure | |||||||||

| Domicialiary Hospitalisation | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Optional Benefits | ||||||||||||

| Hospital Cash*** | 1000 per day | 2000 per day | 4000 per day | |||||||||

| Claim Cost Sharing Options | ||||||||||||

| Annual Aggregate Deductible | Deductible of 1,2,3,4,5 and 10 lacs | Deductible of 1,2,3,4,5 and 10 lacs | Deductible of 1,2,3,4,5 and 10 lacs | |||||||||

| Treatment only in Tiered Network | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | |||||||||

| Benefits | Variant 1 | Variant 2 | Variant 3 | Family First | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 Lacs | 3 Lacs | 4 Lacs | 5 Lacs | 7.5 Lacs | 10 Lacs | 12.5 Lacs | 15 Lacs | 20 Lacs | 30 Lacs | 50 Lacs | 100 Lacs | Base Sum Insured: 1Lacs, 2Lacs, 3Lacs, 4Lacs, 5Lacs & 10Lacs per Insured Person Floater Base Sum Insured - (available on a floating basis over Base Sum Insured): 3Lacs, 4Lacs, 5Lacs, 10Lacs, 15Lacs & 20Lacs. |

|

| Benefits | |||||||||||||

| In-patient treatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Room Rent | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Pre hosptitalization medical expenses (30 days) | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Post hosptitalization medical expenses (60 days) | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Day Care tTreatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Living Organ Donor Transplant | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Emergency Ambulance | Up to 3,000 | Up to 3,000 | Up to 3,000 | Up to 3,000 | |||||||||

| No Claim Bonus | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | In case of any claim, increase of 20% of expiring Base Sum Insured in a policy year; maximum upto 100% of Base Sum Insured | |||||||||

| Refil Benefit* | Up to Base Sum Insured | Up to Base Sum Insured | Up to Base Sum Insured | Not Available | |||||||||

| Vacination for Animal Bite** | Up to 2,500 | Up to 5,000 | Up to 7,500 | Upto 5,000 | |||||||||

| Alternate Treatments | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Health Check-up | Once in 2 years, as per Annexure | Annual, as per Annexure | Annual, as per Annexure | Annual, as per Annexure | |||||||||

| Domicialiary Hospitalisation | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured | |||||||||

| Optional Benefits | |||||||||||||

| Hospital Cash*** | 1,000 per day | 2,000 per day | 4,000 per day | 1,000/day or 2,000/day | |||||||||

| Claim Cost Sharing Options | |||||||||||||

| Annual Aggregate Deductible | Deductible of 1,2,3,4,5 and 10 lacs | Deductible of 1,2,3,4,5 and 10 lacs | Deductible of 1,2,3,4,5 and 10 lacs | Deductible of Rs.1,2,3,4,5 & 10Lacs | |||||||||

| Treatment only in Tiered Network | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | Available only to renewal customers (for life) who opted this cost sharing option in the expiring policy | Available only to renewal customers (for life) who opted this cost sharing option in the expiring Policy | |||||||||

| PERIOD ON RISK | RATE OF PREMIUM TO BE CHARGED |

|---|---|

| Up to 15 days | Full policy premium refundable |

| Up to one-month | 1/3rd of the policy premium |

| Up to three months | 1/2nd of the policy premium |

| Up to six months | 3/4th of the policy premium |

| Exceeding six months | Full policy premium |

The medical expenses traceable to childbirth (including complicated deliveries and caesarean sections during hospitalisation) and the expenses incurred towards any lawful medical termination of pregnancy during the policy period will be covered.

If the insured person is admitted in the hospital in a room category higher than their eligibility as specified in the product benefits table, then we shall only pay a pro-rated proportion of the total associated medical expenses (including surcharge or taxes thereon) in the proportion of the difference between the room rent actually incurred and the entitled room category.

Reasonable and customary charges refer to the expenses incurred for medical services/supplies as long as they are the standard charges for the specific provider and consistent with the prevailing charges in the geographical area for identical or similar services. We also take into account the nature of the illness/injury involved.

Review Health Companion health brochure to understand coverage details.

Know more »Review Health Companion health policy wordings which explains the terms and conditions.

Know more »Review and compare the best health insurance.

You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Insurance customers can quickly compare the details of benefits offered under Indian mediclaim insurance policies.

Know more »Compare Indian health insurance policies, Health insurance India comparison.

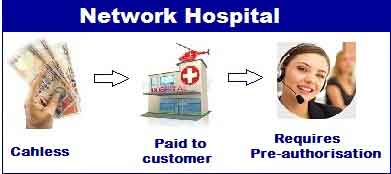

Know more »Niva bupa health insurance network hospitals list. Cashless & Hassle-free direct claim settlement with us at 6,900+ Hospitals

Know more »FAQ related to Indian health insurance. Get answers for any health insurance questions.

Know more »India health insurance tips and tricks to choose the best medical insurance in India

Know more »Find out the different reasons why a medical insurance claim is rejected, Cashless hospitalization, Reimbursement.

Know more »Factors for medical insurance in India, How much is the premium and the coverage offered by India health insurance plans.

Know more »