Tips for buying best mediclaim insurance

India health insurance tips and tricks to choose the best medical insurance in India

Know more » Niva Bupa Go Active Individual & Family Floater insurance

Niva Bupa Go Active Individual & Family Floater insurance

Go Active Family health insurance plans provide coverage for the entire family within the scope of a single health plan. find quotes, compare & buy Go Active Family Quotes for Family

Buy Go Active for Family3 lac - 300 lacs options available

8.0%

88%

23,330

23,330

1 year options available

8,600+ hospitals

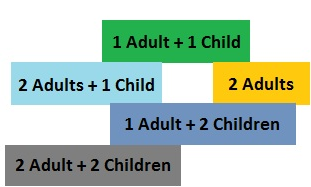

Self, Spouse + 4 dependent children

Naturopathy and homeopathy treatments are not covered under our Heartbeat Health insurance plans. Our coverage is available for allopathic treatments in recognized hospitals and nursing homes.

Yes, your Health insurance covers all diagnostic tests like X- Rays, MRIs, Blood Tests etc. if they are associated with an insured person’s stay in the hospital. These tests must also have been conducted within a maximum of 30 days prior to hospitalization and/or 60 days post hospitalization or during hospitalization. In addition, we cover outpatient diagnostic tests if a specialist prescribes them and if you have chosen the Platinum Policy.

When you get a new health insurance policy, there will be a 90 day waiting period starting from the policy start date, during which period hospitalization charges will not be payable. However, this is not applicable to any emergency hospitalization occurring due to an accident. This 90 day waiting period is not applicable when the policy is renewed.

While filling up your health insurance proposal form, you will need to provide details of any health conditions in your medical history so far. At the time of enrolment, you should be aware of any current medical conditions and if you are undergoing any treatment. We refer such health issues to our medical panel to differentiate between pre-existing and newly contracted conditions. Note: It is important to disclose any medical condition that you may have, prior to buying the health insurance policy. insurance is a contract based on good faith and any willful non-disclosure of facts might lead to repudiation or rejection of a claim in the future.

Review Health Go Active Individual & Family Floater brochure to understand coverage details.

Know more »Fill the online Health Go Active Individual & Family Floater proposal form.

Know more »Review Health Go Active Individual & Family Floater policy wordings which explains the terms and conditions.

Know more »Review and compare the best health insurance.

You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Insurance customers can quickly compare the details of benefits offered under Indian mediclaim insurance policies.

Know more »Compare Indian health insurance policies, Health insurance India comparison.

Know more »Niva bupa health insurance network hospitals list. Cashless & Hassle-free direct claim settlement with us at 6,900+ Hospitals

Know more »FAQ related to Indian health insurance. Get answers for any health insurance questions.

Know more »India health insurance tips and tricks to choose the best medical insurance in India

Know more »Find out the different reasons why a medical insurance claim is rejected, Cashless hospitalization, Reimbursement.

Know more »Factors for medical insurance in India, How much is the premium and the coverage offered by India health insurance plans.

Know more »