Tips for buying best mediclaim insurance

India health insurance tips and tricks to choose the best medical insurance in India

Know more » Niva Bupa Heartbeat health insurance

Niva Bupa Heartbeat health insuranceHealth care is very expensive nowadays. More than the disease itself, it is often the cost of treatment that takes its toll. Health insurance policy covers medical expenses incurred during pre and post hospitalisation stages. Buy Indian health insurance policy for you and your family and get rid of health care expense worries.

Get Quote and Buy Online| Benefits | Silver Policy | Gold Policy | Platinum Policy |

| 2, 3 Lacs | 5, 7.5, 10, 15, 20 & 50 Lacs | 15, 20, 50 Lacs & 1cr In-patient treatment | |

| In-patient treatment | |||

| Medical Practitioner's fees | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Diagnostic procedures | |||

| Medicines, drugs and consumables | |||

| Intravenous fluids, blood transfusion, injection administration charges | |||

| Operation Theatre charges | |||

| The cost of prosthetics and other devices or equipment if implanted internally during a Surical Operation | |||

| Intensive Care Unit Charges | |||

| Hospital accomodation | Shared room or 1% of the Base Sum Insured | Single Private Room | Covered up to Sum Insured |

| Pre and Post hosptitalization expenses including doctor's consulation, diagnostics tests, intravenous fluid, blood transfusion, medicines, drugs and consumables | Covered up to 15% of Base Sum Insured | Covered up to 20% of Base Sum Insured | Covered up to Sum Insured |

| All day-care treatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| OPD benefits | |||

| Outpatient benefits covering specialist consultation and costs of diagnostics tests prescribed by them | Not available | For 15 Lacs - Up to Rs 10,000 For 20 Lacs - Up to Rs 15,000 For 50 Lacs - Up to Rs 20,000 For 1 cr - Up to Rs 40,000 |

|

| Child Care benefits | |||

| Maternity cover for up to 2 deliveries | For 2 Lacs - Up to Rs 20,000 For 3 Lacs - Up to Rs 30,000 |

For 5 Lacs - Up to Rs 40,000 For 7.5 Lacs - Up to Rs 45,000 For 10 Lacs - Up to Rs 50,000 For 15 Lacs - Up to Rs 55,000 For 20 Lacs - Up to Rs 65,000 For 50 Lacs - Up to Rs 80,000 |

For 15 Lacs - Up to Rs 60,000 For 20 Lacs - Up to Rs 75,000 For 50 Lacs - Up to Rs 100,000 For 1 cr - Up to Rs 150,000 |

| New Born Baby Cover uptill the end of current Policy Year | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Vaccinations for children up to 12 years and nutrition and diet consulting | Not available | Covered up to Sum Insured | |

| Further benefits | |||

| Health check up at the time of renewal | Once in 2 years | Annual | Annual tests |

| Organ transplant when medically necessary | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Emergency ambulance | Covered at actual cost in Network Hospitals up to Sum Insured | Covered at actual cost in Network Hospitals up to Sum Insured | Covered at actual cost in Network Hospitals up to Sum Insured |

| Domicialiary Hospitalisation | For 2 Lacs - Up to Rs 10,000 For 3 Lacs - Up to Rs 15,000 |

For 5 Lacs - Up to Rs 25,000 For 7.5 Lacs - Up to Rs 37,5000 For 10 Lacs - Up to Rs 50,000 For 15 Lacs - Up to Rs 60,000 For 20 Lacs - Up to Rs 80,000 For 50 Lacs - Up to Rs 200,000 |

For 15 Lacs - Up to Rs 75,000 For 20 Lacs - Up to Rs 100,000 For 50 Lacs - Up to Rs 250,000 For 1 cr - Up to Rs 400,000 |

| Health Relationship Loyalty Program | 10% equivalent redeemable points of the Last Paid Annual Premium OR Additional 10% Sum Insured of expiring Base sum insured upto a maximum of 50% of base Sum Insured | ||

| International Medical treatment & assistance | |||

| Worldwide excluding USA and Canada | |||

| Emergency Medical Evacuation and Hospitalization outside India | Not available | For 15 Lacs - Up to Rs 150,000 For 20 Lacs - Up to Rs 200,000 For 50 Lacs - Up to Rs 500,000 For 1 cr - Up to Rs 1,000,000 |

|

| Specified Illness Cover for treatment abroad | Not available | Covered up to Sum Insured Worldwide excluding USA and Canada | |

| Optional benefit/feature | |||

| Annual aggregate Deductible | 1 lac/2 lacs/3 lacs | Not available | |

| Co-payment for insured less than 65 yr old | Options of 10% and 20% co-payment | Options of 10% and 20% co-payment | Options of 10% and 20% co-payment |

Family First plan has been designed keeping in mind the health insurance requirements of joint families. It allows you not just to cover your spouse and kids but each and every member of your family.

You can cover up to 14 relationships in your family. ( E.g. Your parents, in-laws, spouse, kids etc )

Option of buying the plan for 2 years thus saving 12.5% premium on the second year.

Treatment for selected 9 diseases, emergency evacuation and hospitalization outside India for platinum plan.

The Plan provides flexibility to families so that they can decide their optimal cover. The sum Insured may be chosen in the following two ways :

1.Individual Sum Insured: An individual insurance cover for each insured person up to Rs.15 Lac. The individual sum insured is same for all family members.

2.Floater Sum Insured: A floating insurance cover that is available to all family members up to Rs.50 Lac and can be used once the individual sum insured is exhausted. This provides flexibility for familes to decide their optimal cover.

Benefit table| Benefits | Silver Policy | Gold Policy | Platinum Policy |

| Individual Base Sum Insured : 1, 2, 3, 4 & 5 Lacs per Insured Person Floater Base Sum Insured : 3, 4, 5, 10 & 50 Lacs |

Individual Base Sum Insured : 1, 2, 3, 4, 5, 10 & 15 Lacs per Insured Person Floater Base Sum Insured : 3, 4, 5, 10, 15, 20, 30 & 50 Lacs |

Individual Base Sum Insured : 5, 10 & 15 Lacs per Insured Person Floater Base Sum Insured : 15, 20, 30 & 50 Lacs |

|

| In-patient treatment | |||

| Medical Practitioner's fees | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Diagnostic procedures | |||

| Medicines, drugs and consumables | |||

| Intravenous fluids, blood transfusion, injection administration charges | |||

| Operation Theatre charges | |||

| The cost of prosthetics and other devices or equipment if implanted internally during a Surical Operation | |||

| Intensive Care Unit Charges | |||

| Hospital accomodation | Rs. 3,000 or Shared room | Single Private Room | Covered up to Sum Insured |

| Pre and Post hosptitalization expenses including doctor's consulation, diagnostics tests, intravenous fluid, blood transfusion, medicines, drugs and consumables | Covered up to 15% of Base Sum Insured | Covered up to 20% of Base Sum Insured | Covered up to Sum Insured |

| All day-care treatment | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| OPD benefits | |||

| Outpatient benefits covering specialist consultation and costs of diagnostics tests prescribed by them | Not available | Covered up to Rs 30,000 per Policy Year | |

| Child Care benefits | |||

| Maternity cover for up to 2 deliveries | Covered up to Rs 25,000 per Policy Year | Covered up to Rs 50,000 per Policy Year | Covered up to Rs 100,000 per Policy Year |

| New Born Baby Cover uptill the end of current Policy Year | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Vaccinations for children up to 12 years and nutrition and diet consulting | Not available | Covered up to Sum Insured | |

| Further benefits | |||

| Health check up at the time of renewal | Once in 2 years | Annual | Annual tests |

| Organ transplant when medically necessary | Covered up to Sum Insured | Covered up to Sum Insured | Covered up to Sum Insured |

| Emergency ambulance | Covered at actual cost in Network Hospitals up to Sum Insured | Covered at actual cost in Network Hospitals up to Sum Insured | Covered at actual cost in Network Hospitals up to Sum Insured |

| Domicialiary Hospitalisation | Covered up to Rs 15,000 | Covered up to Rs 37,500 | Covered up to Rs 250,000 |

| Health Relationship Loyalty Program | 10% equivalent redeemable points of the Last Paid Annual Premium OR Additional 10% Sum Insured of expiring Base sum insured upto a maximum of 50% of base Sum Insured | ||

| International Medical treatment & assistance | |||

| Worldwide excluding USA and Canada | |||

| Emergency Medical Evacuation and Hospitalization outside India | Not available | Covered upto Rs 200,000 for Individual Base Sum Insured of 5 lac, Rs 3,00,000 for Individual Base Sum Insured of 10 lac and upto Rs 5,00,000 for individual Base Sum Insured of 15 lacs | |

| Specified Illness Cover for treatment abroad | Not available | Covered up to Sum Insured Worldwide excluding USA and Canada | |

| Optional benefit/feature | |||

| Annual aggregate Deductible | Not available | ||

| Co-payment for insured less than 65 yr old | Options of 10% and 20% co-payment | Options of 10% and 20% co-payment | Options of 10% and 20% co-payment |

3 lac - 300 lacs options available

8.0%

88%

23,330

23,330

1 year options available

8,600+ hospitals

Self, Spouse + 4 dependent children

You can buy insurance online by using a credit/debit card, UPI, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Insurance customers can quickly compare the details of benefits offered under Indian mediclaim insurance policies.

Know more »Compare Indian health insurance policies, Health insurance India comparison.

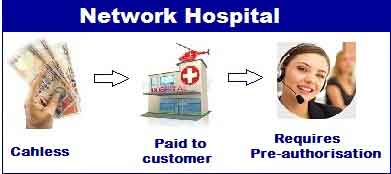

Know more »Niva bupa health insurance network hospitals list. Cashless & Hassle-free direct claim settlement with us at 6,900+ Hospitals

Know more »FAQ related to Indian health insurance. Get answers for any health insurance questions.

Know more »India health insurance tips and tricks to choose the best medical insurance in India

Know more »Find out the different reasons why a medical insurance claim is rejected, Cashless hospitalization, Reimbursement.

Know more »Factors for medical insurance in India, How much is the premium and the coverage offered by India health insurance plans.

Know more »