India Travel insurance Claims FAQ

Each insurance partner works with their respective Assistance Partners across India and abroad. While abroad for any assistance/claim, the insured should reach out to the Assistance Partner on the Toll/Toll Free number which is provided on the policy certificate. If however, you have returned to India, you can get in touch with the insurance company directly and register a claim.

On registration of a claim with the Assistance Partner or the Insurance company directly, the claim form will be forwarded to the insured. The forms are also available on the website of the respective insurance companies. The insured will need to submit the claim form with the supporting documents for processing the claim.

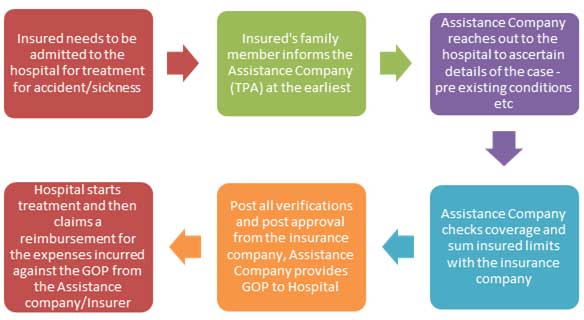

The Assistance/Insurance company will pay up to 100% of the claim (subject to the policy terms and conditions and upto the maximum Sum Insured availed) above the deductible amount (mentioned on the policy certificate) to the medical facility. This will be done either by placing a Guarantee of Payment (GOP) or making a payment to the hospital. This is subject to eligibility of the insured for coverage.

The deductible under the Accident & Sickness is normally USD $100 .The policy deductible is applicable for each instance of sickness/ailment. For continuous treatments relating to the same sickness, the deductible will only be applicable once. The insured is required to quote the Claim reference number when contacting the assistance company while undergoing follow up / re-revisit treatments. The deductible will need to be paid in each instance of a new/ different ailment / sickness.

During discharge of the patient and on preparation of the final bill, the deductible mentioned in the policy schedule is payable by the insured. Apart from this, all expenses that are not payable under the terms and conditions of the policy will also have to be paid by the insured to the hospital / medical facilities. The Assistance/Insurance company will directly pay the allowed expenses to the hospital.

It is advisable that the insured contacts the Assistance Company who will direct them to a Network Hospital in the same locality and assist with a Cashless facility. There is no restriction on the hospital where treatment should be taken. The treatment can be taken in any hospital However, the hospital should be a registered hospital under the local jurisdiction.

No, if later the baggage and/or personal belongings are lost, then any amount claimed and paid to an Insured Person under the baggage delay will be deducted from any payment under the Baggage Loss.

Accident & Sickness Medical Expenses includes ambulance service (to or from the Hospital).

Most insurance companies do not specifically provide the list of network hospitals across the world. It is recommended for the insured to call the Assistance Company (on the toll/toll free numbers provided on the policy certificate) who will direct them to the best available hospital facility depending on the nature of treatment to be availed. In case of an emergency the insured can be admitted to any hospital across the world, and the Assistance Company will ensured cashless coverage subject to admissibility of the claim.

The deductible under the Accident & Sickness is normally USD $100 .The policy deductible is applicable for each instance of sickness/ailment. For continuous treatments relating to the same sickness, the deductible will only be applicable once. The insured is required to quote the Claim reference number when contacting the assistance company while undergoing follow up / re-revisit treatments. The deductible will need to be paid by the insured in each instance of a new/ different ailment / sickness. If the insured is claiming a reimbursement for incurred medical expenses, then the insurance company will reimburse the expenses less the deductible amount.

During discharge of the patient and on preparation of the final bill, the deductible mentioned in the policy schedule is payable by the insured. Apart from this, all expenses that are not payable under the terms and conditions of the policy will also have to be paid by the insured to the hospital / medical facilities. The Assistance/Insurance company will directly pay the allowed expenses to the hospital.

For example assuming that the deductible is $100, and if the medical expense incurred at $8500, then the insurance company will give a guarantee to the hospital to the extent of $8400 and instruct the hospital to collect the $100 directly from the insured at the time of discharge.

Yes, all travel insurance companies do offer direct/cashless settlement to hospitals for inpatient treatment for Accident of Sickness expenses incurred by the insured traveler. Direct settlement is more often referred to as cashless settlement or payment and is the process where the insurance company issues a Guarantee of Payment (GOP) letter to the medical institution (Hospital) confirming coverage for the insured against the treatment being availed by the insured. This GOP is issued to the hospital after the insurance company/its TPA confirms that the insured does have a valid policy and the treatment/ailment is actually covered under the scope of the policy terms and conditions.

It is important for the insured / family member of the insured to inform the Assistance company as soon as the insured is admitted to the hospital for treatment to ensure they don’t end up spending any money from their pocket except the deductible payable for every claim.

The process for Direct / Cashless Settlement is as follows:

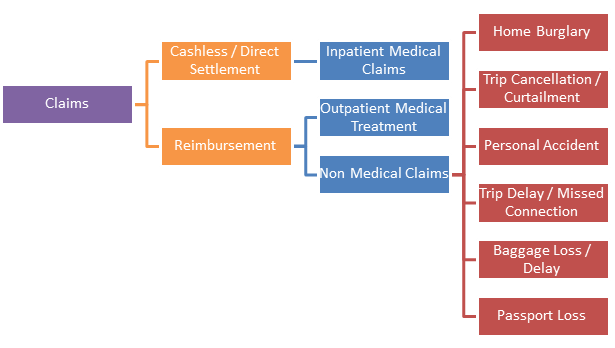

There are two types of claims that an insured can file under a Travel Insurance policy. The first is a Cashless/Direct Settlement claim which is typically for Inpatient treatment for Accident & Sickness Medical expense claims.

The other type of claims are Reimbursement claims where the upfront expenses are incurred by the insured and then a reimbursement is sought from the Insurance company. Reimbursement claim are usually for Outpatient Medical Expense claims and for Non Medical claims like Passport Loss, Baggage Delay/Loss, Trip Delay, Missed Connection, Personal Accident etc. Here the insured is required to retain bills, receipts, documents pertaining to the expenses incurred and then submit the same to the insurance company on their return to India. The documents are submitted along with a claim form which narrates the type of loss incurred and other information including bank details, policy details etc. All insurance companies reimburse these claims against the documents submitted in a standard outer timeframe of 14 working days subject to policy terms and conditions.

Related links

- International Travel Insurance

- Student Insurance

- Asia Travel Insurance

- Senior Citizen's Insurance

- Schengen Travel Insurance

- Family Travel Insurance

- Annual Multi Trip

- Coporate Travel Insurance

- Domestic Travel Insurance

- Pre Existing Coverage Insurance

- Group Travel Insurance

- Visitor insurance no sub-limits

Get quotes for India travel insurance!

Review and compare the best travel insurance.Find the best travel insurance

Tips to find good and adequate international travel health insurance... Know more

Comparison of overseas Healthcare cost and popular tourist destinations... Know more

How to use Indian visitor insurance in case of sudden sickness and accidents... Know more

Indian travel insurance for popular overseas tourist destinations... Know more

India travel insurance useful links

How to buy online?

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Know more »Already outside India

Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Know more »Travel Insurance Online Renewal

Insurance customers can renew their existing policy online before the exipry date at any time.

Know more »

Insurance Claims

In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Know more »

Insurance Benefits

Travellers can understand the difference between benefits offered under indian travel insurance plans.

Know more »How are Claims settled?

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Know more »